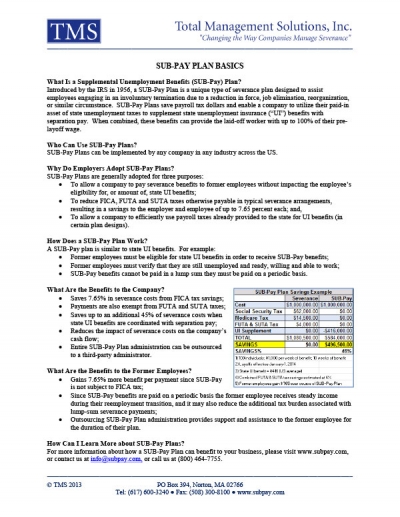

Introduced by the IRS in 1956, a SUB-Pay Plan is a unique type of severance plan designed to assist employees engaging in an involuntary termination due to a reduction in force, job elimination, reorganization, or similar circumstance. SUB-Pay Plans save payroll tax dollars and enable a company to utilize their paid-in asset of state unemployment taxes to supplement state unemployment insurance (“UI”) benefits with separation pay. When combined, these benefits can provide the laid-off worker with up to 100% of their pre-layoff wage.

SUB-Pay Plan Basics

Posted by The TMS Team

Published in

Supplemental Unemployment