William Hays Weissman is an employment attorney and a shareholder at Littler Mendelson P.C., the largest global labor and employment law firm. An attorney with both an M.B.A. and Master of Laws (LL.M.) in Taxation, he specializes in employment taxes and counsels clients on the tax implications of various employer-provided benefits. William is also a noted advocate of an alternative severance program known as a Supplemental Unemployment Benefit (“SUB-Pay”) Plan. Recently, Total Management Solutions asked William why he recommends SUB-Pay Plans to certain clients.

Expense reduction is an on-going priority for most employers today. CFOs and finance departments are largely tasked with finding innovative ways to manage overhead costs. Typical cost reduction efforts focus on cutting expenses such as headcount, materials, supplies, and other purchased items. Compensation and benefits plans also are routinely examined to cut costs, but severance programs often escape the scrutiny of the finance department. This is a missed opportunity to improve severance benefits and save significant dollars.

In recent years, the economic downturn has led to widespread involuntary reductions in workforces across many diverse industries. Because these staff reductions are costly, Fortune 1000 companies have struggled to control severance costs while providing reasonable severance benefits at the same time. Consequently, there has been renewed interest among large companies in an alternative severance program known as a Supplemental Unemployment Benefit (“SUB-Pay”) Plan.

TMS Case Studies

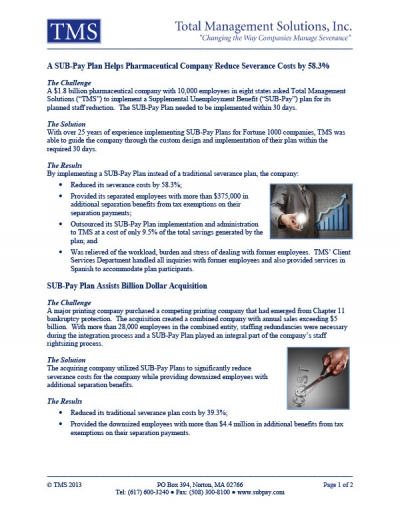

Posted by The TMS TeamA $1.8 billion pharmaceutical company with 10,000 employees in eight states asked Total Management Solutions (“TMS”) to implement a Supplemental Unemployment Benefit (“SUB-Pay”) plan for its planned staff reduction. The SUB-Pay Plan needed to be implemented within 30 days.

With over 25 years of experience implementing SUB-Pay Plans for Fortune 1000 companies, TMS was able to guide the company through the custom design and implementation of their plan within the required 30 days.

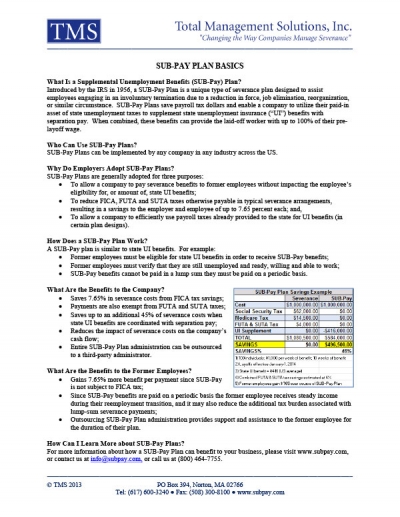

SUB-Pay Plan Basics

Posted by The TMS TeamIntroduced by the IRS in 1956, a SUB-Pay Plan is a unique type of severance plan designed to assist employees engaging in an involuntary termination due to a reduction in force, job elimination, reorganization, or similar circumstance. SUB-Pay Plans save payroll tax dollars and enable a company to utilize their paid-in asset of state unemployment taxes to supplement state unemployment insurance (“UI”) benefits with separation pay. When combined, these benefits can provide the laid-off worker with up to 100% of their pre-layoff wage.